Following the Minnesota Legislature’s passage of multiple major bills during the special session that wrapped up early Tuesday morning, St. Louis County leaders reflected on the wins and losses of the session and issued this statement.

During Tuesday’s County Board meeting, commissioners noted their appreciation for the local delegation for their hard work and advocacy on behalf of the citizens of St. Louis County, recognizing these are challenging times with competing priorities.

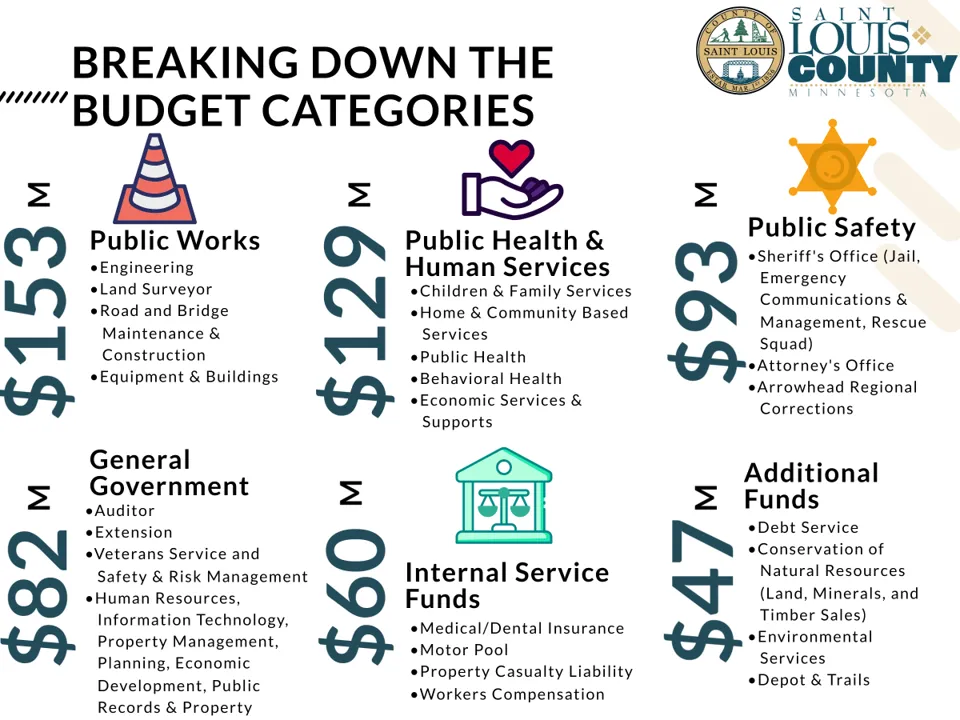

“As the state looked to reduce spending, we worked to ensure their actions didn’t simply transfer costs to counties and our taxpayers,” said County Administrator Kevin Gray. “In that, we and other counties achieved some success. The Tax Bill does not include any cuts to County Program Aid or Payment in Lieu of Taxes (PILT), and the final Human Services Bill did not include some concerning cost shifts that had been proposed.”

County Board Chair Annie Harala added, “We appreciate legislators listening to our concerns regarding the significant impact any cuts would have as we work to provide the services the state requires us to do and that our citizens expect.”

No local projects were included in the bonding bill. Commissioner Paul McDonald, who chairs the county’s Intergovernmental Committee, reaffirmed his commitment to work with legislators to address bonding needs on priority projects, including a new solid waste management campus in Canyon that would serve the entire region.

The Bonding Bill does include continued state investment in the Local Road Improvement, Bridge Replacement and Wetland Replacement Programs.

“We appreciate the State continuing to fund these key programs,” said McDonald. “In a county with 3,000 miles of roads and 600 bridges, these programs are critically important in helping us maintain a safe infrastructure.”

Gray concluded, “We will continue to analyze potential impacts of other legislation approved during yesterday’s fast-paced session. Likewise, we are monitoring impacts from federal legislation and actions that could come this fall. These are challenging times for all levels of government as we face inflationary pressures and seek to find balance between investments in critical infrastructure and other services while also doing all that we can to lessen the tax impact on our citizens and businesses.”