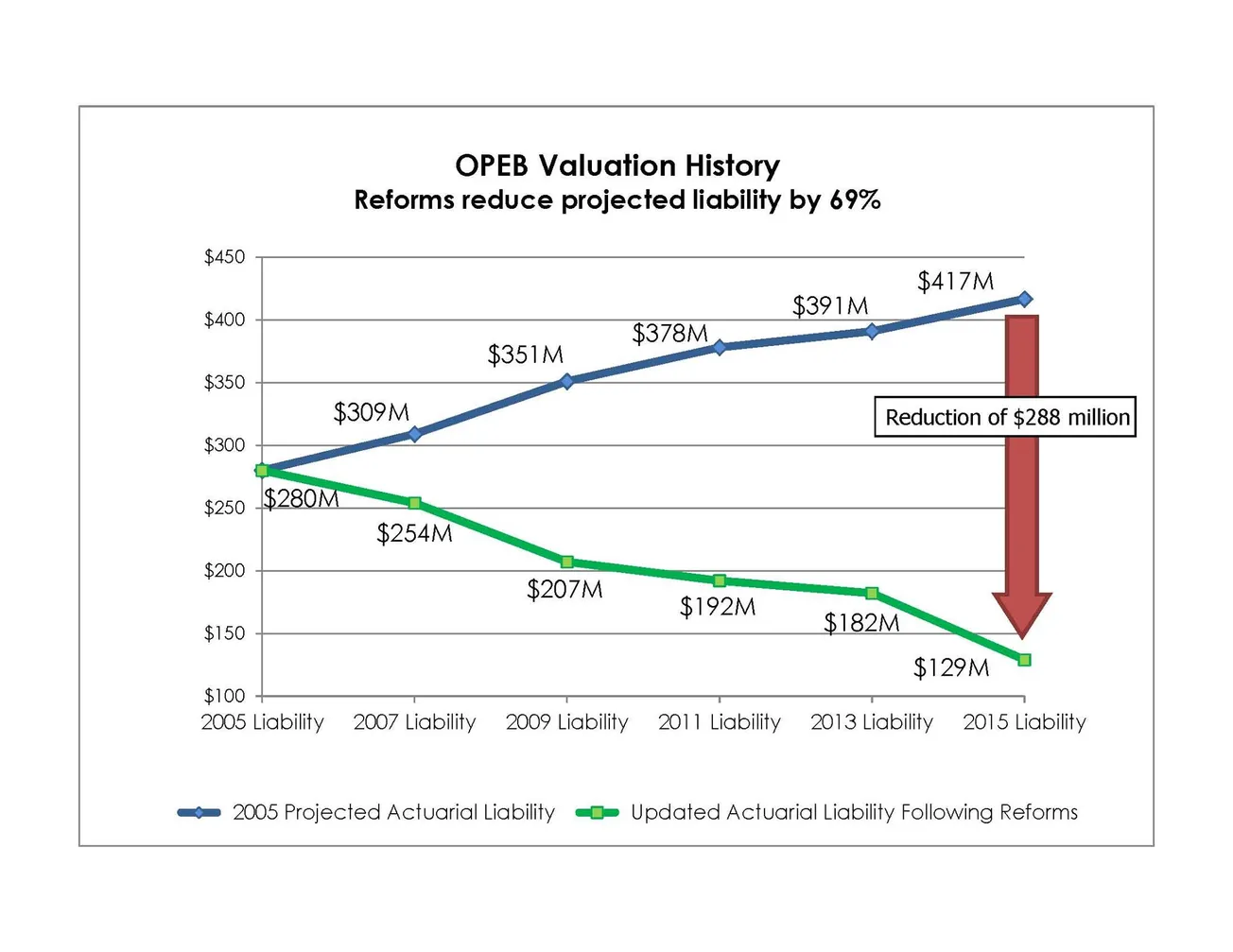

Former Duluth Mayor Don Ness, in a June 30, 2015 post on Facebook: "Ten years ago the State Auditor predicted Duluth would go bankrupt and the New York Times featured Duluth as a city on the brink because of our massive unfunded liability related to retiree health care.

Our unfunded liability in 2005 was $280M and was predicted to grow to $417M by 2015. Projected 2020 retiree health care costs would have exceeded $20M - more than annual city property taxes collected.

Today, a new report shows that our unfunded liability is down to $129M (a $53M drop in the past two years) - possible because we are controlling our costs and setting money aside today for future benefits. It took ten years of incredibly difficult and controversial actions - but today we offer a generous benefit that we can afford and that city retirees can count on. Other cities facing a similar problem went bankrupt.

There are many to thank for this success - city staff, city unions, city councilors, community leaders who supported our efforts, even the MN Supreme Court. But the key of the effort was a small group of five citizen volunteers serving on a task force (that I had set up when I was a city councilor) who provided a 15-point road map to solving what was thought to be an unsolvable problem. That was the most important volunteer effort in the history of our city - it was the basis for the $288M reduction in our liability that you see in this chart. $288 Million!

Sometimes people will ask me what I am most proud of during my time as mayor. There are certainly more exciting and visible accomplishments, but this is the one I care about most."